NON RESIDENT INDIAN (NRI) TAXATION IN INDIA

AS PER FEMA

Who is a Non-Resident Indian?

An Indian abroad is popularly known as Non-Resident Indian (NRI). NRI is legally defined

under the Income Tax Act, 1961 and the Foreign Exchange Management Act, 1999 (FEMA)

for applicability of respective laws.

Difference between Resident definition under Income Tax and FEMA

- "Financial Year" is not defined under FEMA, but by convention it is assumed to refer

to 1st April to 31st March

- Income-tax Act requires physical presence of 182 days or more, whereas, FEMA requires 183 days or more

- Income-tax Act considers the physical presence of a person in the Current Financial

Year, whereas FEMA considers physical presence of a person in the Preceding

Financial Year

NRI as per FEMA

NRI is defined under FEMA as a person resident outside India who is either a citizen

of India or is a Person of Indian Origin (PIO).

PIO means a citizen of any country other than Bangladesh or Pakistan,

- who at any time held Indian Passport, or

- who or either of whose parents or any of the grandparents was a citizen of India

under Constitution of India or under Indian Citizenship Act, 1955, or

- who is spouse of an Indian citizen or spouse of person referred to in 1 and 2 above

"Person resident outside India" is defined indirectly to mean a person who is not resident in

India. "Person resident in India" is a person residing in India for more than 182 days in the

Preceding Financial Year. Preceding Financial Year means the financial year, which ended on

the last 31st of March. Thus for example, as on 11th June 2007, the Preceding Financial

Year would be "2006-07". FEMA also excludes person moving out of India for employment or business from category of Resident. Similarly it also excludes a person coming as tourist / visitor from the category of Resident. Let’s see the detailed definition below:

"Person resident in India" means:

1. Person Resident in India for more than 182 days during the course of Preceding

Financial Year but excludes:

- A person who has gone out of India or who stays outside India:

- for employment outside India; or

- for carrying on a business or vocation outside India; or

- for any other purpose, in such circumstances as would indicate his intention to stay

outside India for an uncertain period.

- A person who has come to India or stays in India for any purpose other than :

- for employment in India, or

- for carrying a business or vocation in India, or

- for any other purpose, in such circumstances as would indicate his intention to stay in

India for an uncertain period;

2. Any person or body corporate registered or incorporated in India;

3. An Office, Branch or Agency in India owned or controlled by a person resident outside

India;

4. An Office, Branch or Agency in India owned or controlled by a person resident in India.

The definition under FEMA is explained in simple terms for individuals hereunder.

1. The residential status of a person leaving India shall be determined as follows:

If a person leaves India for the purpose of employment, business or for any other

purpose that indicates his intention to stay outside India for an uncertain period,

then he becomes a non-resident from the day he leaves India for such purpose.

2. The residential status of a person returning to India will be determined us follows:

If a person comes to India for the purpose of employment, business or for any other

purpose that indicates his intention to stay in India for an uncertain period; then he

becomes a resident from the day he comes to India for such purpose.

As per the definition there is also a requirement of physical stay for more than 182 days

in India in the Preceding Financial Year. But there is some confusion whether this requirement is necessary condition for being classified as Resident. Important to see extract of FAQ given on RBI website:

What is meant by a person resident in India?

From FEMA angle, a person resident in India means a person residing in India for more than

one hundred and eighty-two days during the course of the preceding financial year (April-

March) and who has come to or stays in India either for taking up employment, carrying on

business or vocation in India or for any other purpose, that would indicate his intention to

stay in India for an uncertain period. In other words, to be treated as 'a person

resident in India', under FEMA a person has not only to satisfy the condition of the

period of stay (being more than 182 days during the course of the preceding

financial year) but has also to comply with the condition of the purpose/intention

of stay.

If we take the interpretation of above (although FAQ cannot be regarded as rule of law), it

would appear that a resident is a person who:

1. Spends more than 182 days in India during the Preceding Financial Year AND

2. Does not fall in either (a) or (b) in the definition above.

Point (a) excludes from the definition of FEMA resident those who meet (1) and then go

abroad for an indefinite period, say for employment. Point (b) excludes from the definition

of FEMA resident those who meet (1), but have come to India as visitors/ tourists

to India with a definite plan to return abroad.

However the above interpretation doesn't seem to logically gel with the intent of the

legislation and also the definition of "Person Resident in India" as given under erstwhile

FERA. Let us consider a person who returns to India on 1st Nov 2008 to retire and live

in India for an indefinite period. In the Preceding Financial Year, i.e. period from 1st April

2007 to 31st March 2008, he was not present in India for 183 days. Hence he would be

classified as Non-Resident even though he should be classified as Resident as per clause (b)

in the definition, since he has returned toIndia to stay for an uncertain period. Going by the

earlier interpretation, he would be classified as Resident only from 1st April 2010, since on

that day he would satisfy the condition of 183 day stay in India in the Preceding Financial

Year, i.e. period from 1st April 2008 to 31st March 2009. This definitely is not the intent of

the clause since a person should actually be classified as Resident from the day he returns

toIndia to stay for an uncertain period.

Thus in order to make a definition of a person resident in India workable one has to look

first at the exceptions given in clauses (a) and (b) and if the person is not falling under

either of them, then look at his physical presence in India during the preceding financial

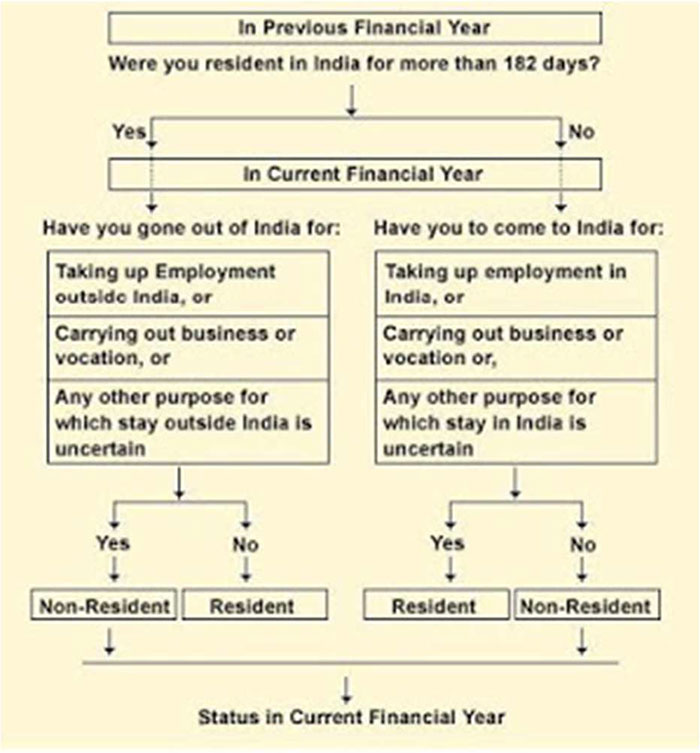

year. The flowchart provides a good basis to determine Residency status of a person under

FEMA.

Posted in: Income Tax,Non Resident Indian

AS PER INCOME TAX ACT 1961

Who is a Non-Resident Indian?

An Indian abroad is popularly known as Non-Resident Indian (NRI). NRI is legally defined

under the Income Tax Act, 1961 and the Foreign Exchange Management Act, 1999 (FEMA)

for applicability of respective laws.

Difference between Resident definition under Income Tax and FEMA

- "Financial Year" is not defined under FEMA, but by convention it is assumed to refer

to 1st April to 31st March

- Income-tax Act requires physical presence of 182 days or more, whereas, FEMA

requires 183 days or more Income-tax Act considers the physical presence of a person in the Current Financial

Year, whereas FEMA considers physical presence of a person in the Preceding

Financial Year

NRI as per Income Tax Act

Income Tax Act has not directly defined NRI. Section 6 contains detailed criteria of who is

considered as Resident in India and provides that anyone who doesn’t meet these criteria is

Non-Resident.

The status of a person as a resident or non-resident depends on his period of stay inIndia.

The period of stay is counted in number of days for each financial year beginning from 1st

April to 31st March (known as previous year under the Income-tax Act).

Resident

An individual will be treated as a Resident in India in any previous year if he/she is

in India for:

1. Atleast 182 days in that year, OR

2. Atleast 365 days during 4 years preceding that year AND atleast 60 days in that

year.

An individual who does not satisfy both the conditions as mentioned above will be treated as

"non-resident" in that previous year.

Definition of Resident is relaxed by dropping Condition 2 given above (i.e. only Condition 1

is applicable), for the following cases:

1. An Indian citizen who leaves India in any year for the purpose of employment

outside India or as a crew member of an Indian ship,

2. An Indian citizen or a person of Indian origin who resides outside India and who

comes on a visit to India. Note that a person shall be deemed to be of Indian origin if

he, or either of his parents or any of his grand-parents, was born in undivided India.

Following examples will make the rules more clear:

1. Ajay leaves India for the first time on 1st August, 2006 and remains out of India in

the remaining part of the financial year. His period of stay in India in the previous

year 2006-07, being less than 182 days, he is not a resident for that year.

2. Divya leaves India in December 2006 and continues to remain abroad in the

remaining part of the financial year. Her period of stay in India being more than 182

days, she will be a 'resident' in the previous year 2006-07.

3. Rohit leaves India in 2003. In the financial year 2003-04 to 2006-07 he visited India

several times and the total period of stay during these 4 years was 400 days. During

the financial year 2007-08, he came to India for total period of 180 days. Although

his stay in India in the financial year 2007-08 is less than 182 days, he becomes a

‘resident’ by virtue of the fact that his stay in the preceding 4 years was more than

365 days and he was in India for more than 60 days in the year under

consideration.

4. In the above examples, if Rohit was a member of the crew of an Indian ship or a

citizen of India or a person of Indian origin, he would not have become a 'resident'

for the year 2007-08 since his period of stay in India in that year was less than 182

days.

"Resident and Ordinarily Resident" & "Resident but not Ordinarily Resident"

A person Resident in India is further classified as "Resident and Ordinarily

Resident" if BOTH the following conditions are satisfied:

1. Resident in India for 9 out of 10 years preceding that year, AND

2. In India for atleast 730 days during 7 years preceding that year

If any one of the above conditions is not satisfied, the person is classified as "Resident but not Ordinarily Resident"

Points to Note

- A Hindu Undivided Family (HUF), firm or other association of persons is Non-Resident

if control and management of its affairs is situated wholly outside India

- A company is said to be resident in India in any previous year, if it is an Indian

company; or the control and management of its affairs is situated wholly in India

- Every other person is said to be Non-resident in India if control and management of

his affairs is situated wholly outside India

If a person is resident in India in respect of any source of income, he shall be

deemed to be resident in India in respect of each of his other sources of income

Residency and Taxable Income

Based on the residential status of a tax payer and the place where the income is earned, the

income that is included in the total income is as under:-

| Residential status |

Nature of Income taxable |

| Resident and Ordinarily

Resident |

All Income whether earned in India or outside India

All incomes :-

1. which is received or is deemed to be received in

India

2. which accrues or arises or is deemed to accrue

or arise in India, and

3. which accrues and arises outside India which

means the world income is taxable in case of a

resident |

| Resident but not Ordinarily

Resident |

All income earned in India and all income earned

outside India if the same is derived from a business

which is controlled in India or from a profession which

is set up in India |

| Non Resident |

All income earned in India. Income outside india is not

liable to tax |

| |

|

A person who is non-resident is liable to tax on that income only which is earned by him in

India. Income is earned in India if:

1. It is directly or indirectly received in India; or

2. It accrues in India or the law construes it as having accrued in India.

The following are some of the instances when the law construes the income to have accrued

in India:-

- Income from business arising through any business connection in India;

- income from property if such property is situated in India;

- Income from any asset or source if such asset or source is in India;

- Income from salaries if the services are rendered in India. In such cases salary for

rest period or leave period will be regarded as earned in India if it forms part of

service contract.

income from salaries payable by the Government to a citizen of India even though

the services are rendered outside India;

- income from dividend paid by an Indian company even if the same is paid outside

India;

- income by way of interest payable by Government or by any other person in certain

circumstances ;

- income by way of Royalty if payable by the Government or by any other person in

certain circumstances;

- income by way of fees for technical services if such fees is payable by the

Government or by any other person in certain circumstances.

The following income even though appearing to be arising in India are construed as not

arising in India:

1. If a non-resident running a news agency or publishing newspapers, magazines etc.

earns income from activities confined to the collection of news and views in India for

transmission outside India, such income is not considered to have arisen in India.

2. In the case of a non-resident, no income shall be considered to have arisen in India if

it arises from operations which are confined to the shooting of any cinematography

film. This applies to the following types of non-residents:-

- Individual who is not a citizen of India; or

- firm which does not have any partner who is a citizen of India or who is resident in

India; or

- company which does not have any shareholder who is resident in India.

DIFFERENT TYPE OF BANK ACCOUNTS

NRIs / PIOs / OCBs are permitted to open bank accounts in India out of funds remitted from

abroad, foreign exchange brought in from abroad or out of funds legitimately due to them in

India, with an authorised dealer. Such accounts can be opened with banks specially

authorised by the Reserve Bank in this behalf. NRIs can open and operate the following five

types of Bank accounts.

1. Ordinary Non-Resident Rupee Accounts (NRO Accounts)

These are Rupee denominated non-repatriable accounts and can be in the form of savings,

current recurring or fixed deposits. These accounts can be opened jointly with residents in

India. When an Indian National / PIO resident in India leaves for taking up employment,

etc. outside the country, his bank account in India gets designated as NRO account.

The deposits can be used to make all legitimate payments in rupees. Interest income, from

NRO accounts is taxable. Interest income, net of taxes is reportable. NRO account can be

funded through any of the following sources:

By proceeds of foreign exchange remittance from abroad through banking channels

in an approved manner

- By proceeds of foreign currency notes and traveler cheques brought into India by the

non-resident while on a temporary visit to India

- By transfer from an existing non-resident account in the name of the same person

- By funds from a local source representing bonafide transactions in rupees

Conditions regarding repatriation of balances in NRO accounts:

- Repatriation is allowed up to US dollars 1 million per calendar year for any purpose

from the balances in NRO accounts subject to payment of applicable taxes

- Limit of US dollars 1 million includes sale proceeds of immovable properties held by

NRIs / PIOs for a period of 10 years

- In case a property is sold after being held for less than 10 years, remittance can be

made if the sale proceeds have been held by the NRI/PIO for the balance period

2. Non-Resident (External) Rupee Accounts (NRE Accounts)

NRIs, PIOs, OCBs are eligible to open NRE Accounts. These are rupee denominated accounts

and can be in the form of savings, current, recurring or fixed deposit accounts. Accounts

can be opened by remittance of funds in free foreign exchange. Foreign exchange brought

in legally, repatriable incomes of the account holder, etc. can be credited to the account.

Joint operation with other NRIs/PIOs is permitted. Power of attorney can be granted to

residents for operation of accounts.

The deposits can be used for all legitimate purposes. The balance in the account is freely

repatriable. Interest lying to the credit of NRE accounts is exempt from tax in the hands of

the NRI. Funds held in NRE accounts may be freely transferred to FCNR accounts of the

same account holder. Likewise, funds held in FCNR accounts may be transferred to NRE

accounts of the same account holders.

Immediately upon return of the account holder to India and on his becoming a resident in

India, NRE Account will be re-designated as Resident Rupee Account or converted to RFC

account as per the option of the account holder. However, if the account holder is only on a

short visit to India, the account will continue to be treated as NRE account.

The initial deposit in NRE account can be made in any of the following manners:

- By proceeds of foreign exchange remittances from abroad through banking channels

in an approved manner

- By proceeds of foreign currency notes and traveler cheques brought into India by the

non-resident while on a temporary visit to India

- By transfer from an existing NRE Account of the same person

3. Foreign Currency (Non –Resident) Accounts (Banks) (FCNR (B) Accounts)

NRIs / PIOs / OCBs are permitted to open such accounts in US Dollars, Sterling Pounds,

Australian Dollars, Canadian Dollars, Japanese Yen and Euro. The account may be opened

only in the form of term deposit for any of the following maturity periods; (a) one year and

above but less than two years, (ii) two years and above but less than three years, (iii) three

years and above but less than four years, (iv) four years and above but less than five years,

and (v) five years.

Interest income is tax free in the hands of NRI until he maintains a non-resident status or a

resident but not ordinarily resident status under the Indian tax laws. Money lying in FCNR

(B) accounts can also be utilised for local disbursements including payment for exports from

India, repatriation of funds abroad and for making investments in India, as per foreign

investment guidelines.

4. Non-Resident (Non-Repatriable) Rupee Deposit Accounts (NRNR Accounts)

NRIs / PIOs / OCBs, other non-resident Individuals/entities are permitted to open these

accounts by transfer of freely convertible foreign currency funds from abroad, or from NRE /

FCNR accounts. Non-residents can open joint accounts with other Non-Residents (except

Pakistan and Bangladeshi nationals) or resident close relatives in India. Deposits can be

held jointly with a resident. Deposits can be for a period from 6 months to 3 years, and can

be renewed further. Accounts may also be opened by transfer of funds from the existing

NRE/FCNR accounts of the non-resident accounts holders.

The principal is non-repatriable; interest can be repatriated. There is no income tax on the

interest. Accounts under the Non-Resident (Non-Repatriable) Rupee Deposit Scheme may

be opened in Indian rupees out of the funds in freely convertible foreign exchange

transferred for the purpose to India in an approved manner from the country of residence of

the prospective non-resident account holder or from any other country. Transfer of funds

from the existing NRE / FCNR Accounts of the non-resident account holder may also open

accounts.

5. Non-Resident (Special) Rupee Accounts with banks in India

NRIs/PIOs presently have the facility of maintaining bank accounts and undertaking

financial transactions in India subject to certain exchange control regulations.

In order to simplify the procedures and to provide greater freedom to NRIs/PIOs for putting

through financial transactions in India, NRIs and PIOs are now permitted to open bank

accounts in India, which will be at par with rupee accounts, maintained by residents. They

can now open Non-Resident (Special) Rupee Accounts with banks in India which will have

the same facilities and restrictions as are applicable to rupee accounts maintained in India

by residents relating to repatriation of funds held in these accounts and/or income/interest

earned on them. The procedure for opening such accounts is the same as that of domestic

accounts of resident individuals. The existing facilities for NRIs / PIOs to maintain and

operate NRO, NRE and FCNR accounts also continues. The repatriation facilities available

under these accounts will continue as before.

Given below is comparison between NRO, NRE and FCNR (B) accounts:

| Accounts and features |

NRO |

NRE |

FCNR(B) |

| Purpose of Account |

To park Indian earnings

like rent, Indian salary,

dividend etc. |

To park overseas savings

remitted toIndia after

converting to INR |

To park overseas savings

without converting into

INR |

| Who can

open an

account |

Any person resident

outsideIndia (other than

a person resident

in Nepal andBhutan).

Individuals / entities

ofBangladesh/Pakistannat

ionality / ownership as

well as erstwhile OCBs

require prior approval of

RBI) |

NRIs(individuals / entities

ofBangladesh/Pakistan nati

onality/ ownership require

prior approval of RBI) |

NRIs (individuals /entities

ofBangladesh/Pakistan nati

onality/ ownership require

prior approval of RBI) |

| Nominatio

n |

Permitted |

Permitted |

Permitted |

| Currency

in which

account is

denominat

ed |

Indian Rupees |

Indian Rupees |

Pound Sterling, USDollar,

Japanese Yen, Euro,

Canadian Dollar and

Australian Dollar |

| Account

Types |

Savings Bank Account

Fixed Deposit

Current Account |

Savings Bank Account

Fixed Deposit

Current Account |

Fixed Deposit |

| Joint

Holding |

Both with resident / nonresident |

Only with NRIs |

Only with NRIs |

| Tax

deducted

at source |

Subject to tax deducted

at source |

Exempt from tax deducted

at source |

Exempt from tax deducted

at source |

| Repatriation of Principal |

The principal amount is

not repatriable and can

be used only for local

payments. Funds up to

USD 1 million (or

equivalent) per financial

year can be repatriated

out of the balance held in

NRO accounts for

theeducation of your

children, for medical

expenses for your family

and you, etc. |

Freely Repatriable |

Freely Repatriable |

| Repatriation of

Interest |

Freely Repatriable |

Freely Repatriable |

Freely Repatriable |

| Period for

fixed

deposits |

As applicable to resident

accounts. |

At the discretion of the

bank |

For terms not less than 1

year and not more than 5

years. |

| Rate of

Interest |

Banks are free to

determine their interest

rates on savings deposits

under NRO Accounts.

However, interest rates

offered by banks on NRO deposits cannot be higher

than those offered by

them on comparable

domestic rupee deposits. |

Banks are free to

determine the interest

rates of saving’s and term

deposits of maturity of

one year and above. Interest rates offered by

banks on NRE deposits

cannot be higher than

those offered by them on

comparable domestic

rupee deposits. |

Subject to cap:

LIBOR / SWAP rates + 200

basis points for tenor of 1

year to less than 3 years

& LIBOR / SWAP rates+ 300 basis points for tenor

of 3 years to 5 years

(w.e.f. May 4, 2012) for

the respective currency /

corresponding maturities. |

| Operations

by Power

of

Attorney in

favour of a

resident

by the

nonresident

account |

Operations on the

account in terms of

Power of Attorney is

restricted to withdrawals

for permissible local

payments or remittance

to the accountholder

himself through normal

banking channels. |

Operations on the account

in terms of Power of

Attorney is restricted to

withdrawals for

permissible local

payments or remittance to

the account holder himself

through normal banking

channels. |

Operations on the account

in terms of Power of

Attorney is restricted to

withdrawals for

permissible local

payments or remittance to

the accountholder himself

through normal banking

channels. |

| Loans

a. In India

i) to the

Account

holder

ii) to Third

Parties |

Permitted |

Permitted up to Rs.100

lakhs

Permitted up to Rs.100

lakhs |

Permitted up to Rs.100

lakhs

Permitted up to Rs.100

lakhs |

| b.Abroad

i) to the

Accounthol

der

ii) to Third

Parties |

Not Permitted

Not Permitted |

Permitted

(Provided no funds are

remitted back to India and

are used abroad only)

Permitted

(Provided no funds are

remitted back to India and

are used abroad only) |

Permitted

(Provided no funds are

remitted back to India and

are used abroad only)

Permitted

(Provided no funds are

remitted back to India and

are used abroad only) |

| c.Foreign

Currency

Loans

in India

i) to the

Account

holder

ii) to Third

Parties |

Not Permitted

Not Permitted |

Not Permitted

Not Permitted |

Permitted up to Rs.100

lakhs

Not Permitted |

| Purpose of

Loan

a.In India

i) to the

Account

holder |

Personal requirement and

/ or business purpose * |

i) Personal purposes or for

carrying on business

activities. *

ii) Direct investment

in India on nonrepatriation

basis by way

of contribution to the

capital ofIndian firms / companies

iii) Acquisition of flat /

house in India for his own

residential use. (Please

refer to para 6(a) of Sch.1

toFEMA 5) |

i)Personal purposes or for

carrying on business

activities. *

ii)Direct investment

in India on nonrepatriation

basis by way

of contribution to the

capital ofIndian firms / companies

iii)Acquisition of flat /

house in India for his own

residential use. (Please

refer to para 9 of Sch. 2 to

FEMA5) |

| ii) to Third

Party |

Personal requirement and

/ or business purpose * |

Fund based and / or nonfund

based facilities for

personal purposes or for

carrying on business

activities *. (Please refer

to para 6(b) of Sch. 1to

FEMA 5) |

Fund based and / or nonfund

based facilities for

personal purposes or for

carrying on business

activities *. (Please refer

to para 9 of Sch. 2 toFEMA

5). |

| b. Abroad

To the

account

holder and

Third Party |

Not permitted. |

Fund based and / or nonfund

based facilities for

bonafide purposes. |

Fund based and / or nonfund

based facilities for

bonafide purposes. |